I’m resolved to keep better books this year. True story.

Over the last month or two I’ve spent a fair amount of time playing “catch up” with our finances. I did what I told you not to do, I went months without reconciling the checkbook. Oh yes. The irony in writing a post entitled, Do Bookkeeping Often.

I knew we had money; I check the bank balance regularly. But, making sure my records were in order? Major fail.

I spent several days sitting at the computer, entering transactions, figuring out categories, and making my accounts reconcile with the bank’s.

I found out that I’m not the only one who does this “putting off for tomorrow” kind of thing. My sister and a friend both have lamented the same. And my own tax lady got my taxes done before her own. Thankful that there are other folks in my same boat.

This year I’ve decided that I’m going to keep better books. For reals. Organized feels like prepping for taxes in a (relatively) painless way.

I’m doing a couple things to make it happen this time.

1. Set a regular date.

I’ve decided that Mondays are the day to fill in the transactions of the week previous and have a money meeting with my husband. As a result, we’ve talked about things that I hate to think about and often put off, like refinancing our rental property, getting life insurance, and being better about retirement investments as well as the regular questions of what do we need to buy or pay for in the next few weeks and how can we save more money.

If we talk about it on a weekly basis, we might actually fill out those loan papers and sign up for the life insurance.

2. Make it easy.

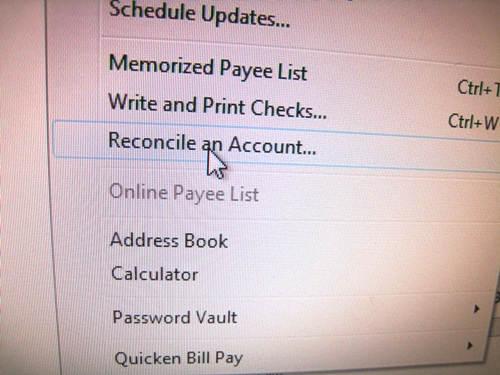

We looked at a bunch of different bookkeeping apps and such, well, hubby did, and came to the conclusion that Quicken 11 works just fine. The problem is not the app or the software, it’s the person entering data. I don’t think learning a new system will make my bookkeeping better, actually sitting down and doing it will. See point #1.

I’ve used Quicken for 16 years and I understand how it works. It provides the info that we need for taxes. I’m going to guess that I could learn more about the program and it would do even more for me. But, it’s good enough and it’s easy.

3. Organize it.

I’ve done a few things to make bookkeeping and bill paying easier this year.

- I pre-printed address labels for our rental company so I can quickly get the rent check in the mail. I’ve also pre-addressed envelopes for quarterly taxes.

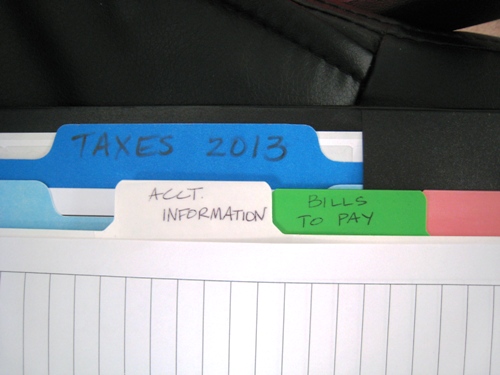

- I set up a Taxes 2013 file to hold important documents that might come throughout the year.

- I’ve got receipt envelopes labeled for every month of the year for storing receipts after I input the information.

- I printed multiple copies of my Financial Stats tracking form to make money meetings easier to put together.

- I put together a new finances notebook that includes all the account information and the above mentioned items, so that it’s easy to locate as well as a help to my husband in case something happens to the resident bookkeeper (me).

4. Reward thyself.

I very rarely buy something for myself just because. Sitting at the computer for days at a time costs me something. So, why not put the two together and reward myself for staying on top of things.

This month I treated myself to the Blu-ray copy of Pride and Prejudice. Oh yes, yes, I did. I figure this is fabulous incentive to keep better books this year.

Keeping better books in 2013 will save me time and money and a few headaches, too.

Go a tip for better bookkeeping?

Tell us! This is Frugal Friday. In an effort to make these weekly financial discussions more interactive, I’m no longer posting a link-up. Feel free to leave a link in the comments. But better yet, chat with us on today’s topic.

This post does include Amazon affiliate link(s). If you make a purchase through those links, I am paid a small amount in way of advertising fees.

How to Keep Better Books (Frugal Friday) is a post from: Life As Mom. © Jessica Getskow Fisher - All rights reserved.